|

When

shopping for real estate, my heart soars when I see a dirty

kitchen or smell a grungy carpet. Such houses normally sell at a

discount, and it usually doesn't take much to spruce them up.

I

also like FSBO properties. As I'll explain in the Buyers'

Agents chapter, it's easy to buy them without going

through a buyers' agent and many sellers are willing to drop the sales price by

2-3% if they're spared the expense of paying that commission. That comes to a $10,000-15,000

savings on a $500,000 house.

You

can get a commission rebate on non-FSBO properties in many states

if you do some of the legwork yourself. But be

careful. The simple act of visiting an open house or model

home could jeopardize your ability to get a rebate worth

thousands of dollars. See my buyers' website,

CapturetheCommission.com

to learn more.

Where to get information about properties for sale

I recommend that you don't visit a real estate office until

you've done some research on your own. A buyer's agent will likely

get your name and phone number, give you a map and a printout of

available properties in your price range, and offer to show them to

you. But as I explain in the Buyers'

Agents chapter, accepting help can cost you thousands of

dollars. I recommend that you first check out some alternative sources of information:

- Realtor.com

- Homepages.com

- FSBO

websites

- Regional

Multiple Listing Service (MLS) sytems.

These often provide more information than Realtor.com. See my resources

section for a directory of MLS websites that the public can search,

listed by state.

Some real estate agents offer online access to the local MLS

database, but you have to register to access this information.

If you register, expect to get a lot of phone calls.

|

Since

real estate agents are in the business of selling information,

they're understandably reluctant to give it away for free.

Fortunately, you can uncover a lot of information yourself by doing

research on the Internet and by visiting open houses. |

- Classified

ads in the newspaper.

- Online

classified ad services, like Craigslist.org,

backpage.com, livedeal.com,

base.google.com, and propsmart.com.

- Breakfast

meetings for real estate agents. Many local realtor

associations arrange weekly breakfast meetings during which agents

present their new listings. They're open to the public, but

hardly anyone outside of the real estate business seems to know

about them. Expect to pay $5 or so for coffee and sweet rolls,

and then go sit in a quiet corner where you won't attract too much

attention.

- Drive

around. You can sometimes find FSBO houses just by driving

through neighborhoods. A lot of homes also have open houses on

Sunday afternoons--you can often find them just by looking for

signs.

- Craigslist.org.

This is an online classified ad service.

|

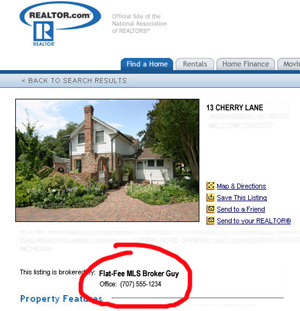

The

National Association of Realtors (NAR), which controls Realtor.com,

won't allow listings to reveal a FSBO seller's identity

to the public. There's a reason for this.

Knowledgeable buyers who know a property's being sold FSBO will

simply cut realtors out of the transaction. Realtors stand

to lose (and buyers to gain) thousands of dollars if they

succeed. |

Visiting open houses or model homes

You

run a big risk

when you visit open houses or model homes that aren't FSBO: the

agent on duty could argue that he or she "showed" you the

house and is therefore entitled to all or part of the buyer's agent's

commission. See my website

www.CapturetheCommission.com to learn more.

FSBO

open houses are usually safe to visit, but sometimes FSBO sellers

make the mistake of allowing agents to host their open houses.

If this is the case, leave the open house immediately and call the

seller later to schedule a personal showing.

Watch out for downward-spiraling neighborhoods

As foreclosures have

increased, many of the homes on the market in certain states are being

sold by banks. Called "bank-owned" or "REO" (real estate owned),

these properties are often priced to sell quickly.

But be careful.

When lenders sell repossessed homes at fire-sale prices, it tends to

push down property values. As a result, more homeowners in that

area can become "upside-down" on their loans, and owe more than their

properties are worth. That makes it harder for them to refinance

their loans if circumstances change and they can't make their payments.

So more of them can get pushed into foreclosure, which leads to more

bank-owned properties in that area, which leads to still lower property

values and still more foreclosures.

You don't want to buy in

an area that's in that kind of downward spiral. Before buying, go

to a website like

Foreclosures.com to see if there are lots of REO or pre-foreclosures

in your target zip code. If there are, it may be best to wait

until prices stabilize before buying.

Good questions to ask sellers

- Ask if anything's wrong with the house.

- If the home is in an

area prone to natural disasters, ask

the seller for a C.L.U.E.

(Comprehensive Loss Underwriting Exchange) report for the house.

This lists all insurance claims that have been made on the house for

the past five years.

- Ask

if there are any problems with neighbors.

- Ask what

upgrades or remodeling the sellers have done since they purchased

the home. You'll be able to use that information later to tweak

any online appraisals you get of the property (through, say, Zillow or

Ditech).

- Ask to see utility

bills for the past year.

Additional

research

- Sperling's

Best Places is a good source of information about crime rates,

schools, weather, and so forth.

- Find

out how long the property's been on the market. If it's an old

listing, you may be able to get a good deal. One way to find

this out is to look up the property on a local

MLS directory (see my resources section

for a list of these), which often gives the date the property was

first listed. Alternatively, you could ask the agent or

seller, or look at the MLS listing number on Realtor.com and see how

it compares with the numbers of more recent listings. Be wary,

though, since agents sometimes relist properties in order to make

them look fresher.

- Talk

to neighbors.

-

GreatSchools.net ranks

school districts in different areas.

- In California,

visit the

Megan's Law website to

see if any registered sex offenders live nearby

- If

you're buying land, go to the county planner and discuss zoning

restrictions on the parcel.

- Call

an insurance company to verify that the home is

insurable.

- If

the home is governed by a homeowners association (HOA), ask about

monthly fees and CC&Rs.

If you're buying a condo or cooperative unit, ask to see the

association's legal and financial documents.

-

Walkscore.com scores the "walkability"

of a neighborhood by seeing how close homes are to stores,

restaurants, and public transit.

- Download

parcel maps and other deed information from websites. In many

western states, you can find a treasure trove of information at netronline.com

for $3 each.

|

Before making an offer on a house, I like to

stroll through the neighborhood. I invariably find one or two

neighbors outside doing gardening or unloading groceries. They almost always give me useful

information. |

Next topic: Buyers'

agents

ŠLori

Alden, 2008. All rights reserved.

|

|